Important Update: Community URLs redirect issues are partially resolved. Learn More. .

- Archer Community

- News, Events & Groups

- Archer Blogs

- RSA Archer Risk Catalog

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

What is Operational Risk?

The Risk Management Association defines operational risk as “the risk of loss resulting from inadequate or failed internal processes, people, and systems, or from external events.” Sources of operational risk include natural and man-made disasters, cyber-attacks, errors, fraud, and regulatory or contractual non-compliance.

Why is the proper management of Risk so important?

In addition to operational risk, organizations today face a wide range of risks originating in different areas of their business, including risk to achieving strategies and objectives, credit risk, interest rate, liquidity, and market risk, political risk, and reputation risk, to name a few. Many of these risks arise within the four walls of the organization and many are inherited through the extended third-party ecosystem that the organization engages.

As an organization grows in size and complexity, converts to digital, moves into new markets, introduces new, more sophisticated or novel products and services, is subject to more regulatory obligations, extends its third party dependencies, or is exposed to political, social, or environmental challenges, it becomes much more difficult for the organization’s management and board of directors to understand and manage its risks. Without a clear understanding of their risks, these organizations tend to experience more surprises and losses, and have a more difficult time achieving their objectives and strategies. Some of these risks may threaten the very existence of the organization, or the livelihood of its managers and board of directors. Consequently, these risks must be effectively identified, assessed, and managed to protect the organization’s leadership and ensure the organization can meet its objectives.

RSA Archer Risk Catalog

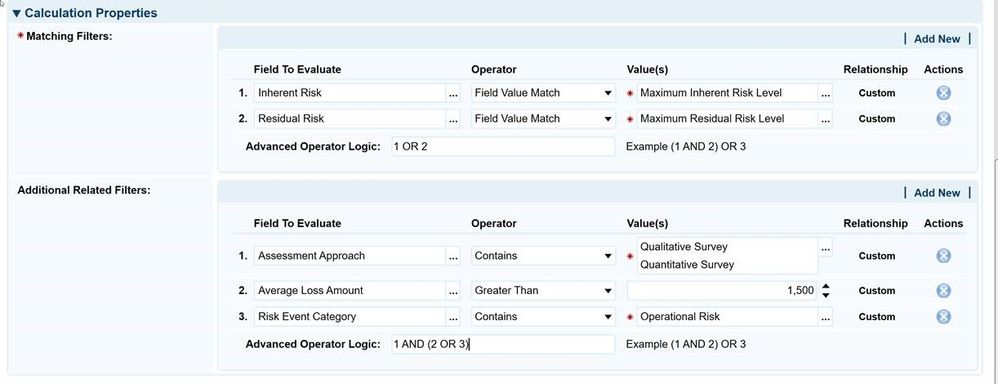

RSA Archer Risk Catalog provides the foundation to record and track risks across your enterprise, and establish accountability by named first and second line of defense managers. It provides a three-level roll-up of risk, from a granular level up through enterprise risk statements. Inherent and residual risk can be assessed utilizing a top-down, qualitative approach, with assessed values rolling up to intermediate and enterprise risk statements.

Key features include:

- Consistent approach to documenting risk, assigning accountability, and assessing risks

- Oversight and management of all risks in one central location

- Ability to understand granular risks that are driving enterprise risk statements

- Consolidated list of prioritized risk statements

RSA Archer Risk Catalog enables organizations to:

- Obtain a consolidated list of the organization’s risk

- Enforce a consistent approach to risk assessments

- Prioritize risks to make informed decisions about risk treatment plans

- Create accountability for the ownership and management of risk

The RSA Archer Risk Catalog is an essential use case of the RSA Archer Ignition Program, designed to empower organizations of all sizes to respond to risk with data-driven facts using a streamlined, fast time-to-value approach.

Today, organizations are faced with complex and fast moving challenges. RSA Archer Risk Catalog is one element of an effective Integrated Risk Management program. Stressing the agility and flexibility needed by today’s modern organizations, integrated risk management brings together the various domains of risk across business activities (horizontally), connecting the activities to the strategies and objectives of the organization on an aggregated basis (vertically). This approach to risk management provides leaders with the most holistic understanding of risk facing their organization so they can make truly informed decisions about where to deploy limited capital and human resources to produce optimized returns for the organization while maximizing the likelihood of achieving the organization’s objectives.

As your organization grows and changes, your risk management program must evolve and manage risk more holistically, with more agility and integration than before. Effective risk management is essential for improving an organization’s risk profile. RSA Archer can help your organization better understand and manage its risk on one configurable, integrated software platform. With RSA Archer solutions, organizations can efficiently implement risk management processes using industry standards and best practices and significantly improve their business risk management maturity.

For more information, visit RSA.com or read the Datasheet.